Caiani et al: Money, Consistency, and a Benchmark Model

In 2019 I started reading about Agent-based models (ABM). Despite being an up and coming field, there was already a huge body of literature. Too many models to individually understand and appreciate. How can I be more systematic?

Reading blindly across papers, I had only scratched the surface and reached a state of confusion. I had questions: How do I properly identify the underlying similarities, and differences? Which differences work? How can I compare models? What appears to be missing across the board? What questions haven't been asked?

I downloaded all ABM papers since 2015 as a start and filled any gaps as I went. This led me to discover various families of models existing (along the lines of those identified in Dawid and Delli Gatti). In doing so I formulated a plan to tackle this swath of literature and a series of questions to ask. Step one - identify the foundational papers in each ABM family, and understand their contributions to the field (why did it take off?). This is the first in a series of posts in which I hope to answer this question. To start, I picked one of my recent favorites: Agent based-stock flow consistent macroeconomics: Towards a benchmark model by Caiani et al. (2016). The use of benchmark model in the title sounded too intriguing...

Money - Who makes it?

In this 2016 paper, Caiani and his co-authors propose a stock-flow consistent agent-based model for a single-country macroeconomy. After reading through the frequently present discussion of the limitations of classic DSGE (Dynamic Stochastic General Equilibrium) models, we arrive at the core economic issue that the paper tackles: the structure and effects of endogenous money creation in agent-based models.

It is often assumed that financial institutions are simply intermediaries (with some frictions) that lend out deposits of real resources from savers to borrows. This is not so, as

In reality banks do not intermediate, but rather create additional means of payment ex-novo by granting loans to non-bank customers. Every new loan recorded on the asset side of the bank's balance sheet is immediately offset by a matching liability in the form of a new deposit, so that the loan creation process corresponds to an expansion of the bank's balance sheet.

From this the authors derive two consequences:

- The national accounting identity for savings and investment implies lending is a pre-condition for savings, and

- If banks are free to create claims that are accepted payment, credit creation potential has no upper bound in the amount of savings in the economy.

Effectively, money creation is driven by the banks' assessment of the implications of new lending. A bank can "create money instantaneously by expanding their balance sheet" - that is they grant new loans which are added to bank assets (receivable) and immediately offset with a liability (deposit). This is precisely what Caiani et al. aim to capture - the endogenous creation (and destruction) of money, which causes financial instability.

This is also in contrast to the way that legal money is thought about often - namely either the stock of money is constant. If it does grow, it is at an exogenous rate and is redistributed in lump-sum fashion to consumers. They suggest two more realistic channels:

- Cash advances from the Central Bank to banks at the CB policy rate. As Demand ~ Deposits this reflects endogenous dynamics of loans and their matching deposits

- Fiscal policy - the government transfers to the private sector. This increases the deposits of the receiving agent and equally the reserves of the bank holding that deposit

The reverse also holds true, as money is destroyed when a private agent transfers to the government. Reserves must be available for this (thus gov't spending precedes financing). An identity suggested in the paper is as follows:

In a closed economy (excl. CB cash advances): the amount of legal reserves and paper money in the private sector (bank + CB bonds) MUST match the amount of government bonds purchased by the Central Bank

In terms of policy, this implies that government spending funded by selling bonds to the Central Bank provides safe liquid assets to the financial system, which can be used as buffer in times of uncertainty and instability. We need to spend to finance, more importantly we need to spend to ensure the well-being of citizens in times of instability (If interested, Claudia Sahm has some interesting commentary on the debate about the stimulus bill in the U.S.).

Stock Flow consistency - Auditing for Economists

The second contribution this paper made is basing their macroeconomic ABM on stock-flow-consistency (SFC). SFC refers to the use of macroeconomic identities, or social accounting matrices, to account for each flow and stock of payment has a source and a destination. We effectively eliminate any black holes. It seems like a very natural and oddly trivial thing that one would expect all models to do, but unfortunately many still have sink-holes. Alas, it might be beside the point for smaller pedagogical models, but I think it is vital for these larger scale macroeconomic simulation models. The literature on this is sourced almost entirely from the work of Wynne Godley [1] and colleagues, who actually used this approach to point out the systemic risk in the 2000's and predict quite accurately the timing and mechanics of the 2008-09 financial crisis (for a recent review see Caverzasi & Godin, 2015, Post-keynsian stock-flow-consistent modelling).

Surprisingly, SFC isn't very common in ABMs. Caiani et al. point out one example, which is in the firm entry/exit process. Oft new firms with a given stock of capital and assets replace them. Where does that capital come from? Since they simply appear, this is an exogenous positive shock to model dynamics (counteracting the negative default shock). Banks need to record new deposits, which is a negative shock to their balance sheets.

There are a few models [2] that apply SFC principles to agent-based economics, with different approaches and different economic issues. The only model to begin with agents' balance sheets is the EURACE model [3] - though its sheer size and complexity makes it inaccessible.

In principle I think SFC is a great tool - it imposes important accounting principles including the transaction flow matrix and the full integration matrix (zero rows and columns), as well as the aggregate balance sheet. In a sense it is like having an auditor come to verify the model's accounting. In this respect, I would suggest stock-flow consistency become a requirement for agent-based models in addition to level-2 validation. It would essentially answer Tesfatsion's request for process validation.

The Model

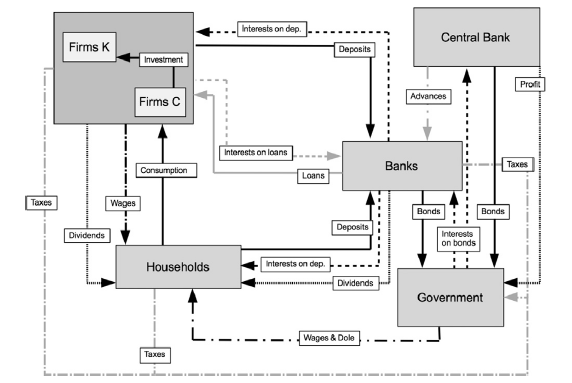

The remainder of the model is rather straightforward in the sense that it aligns with common practices in the Macro-ABM communities. The households are simple, and the producing firms take a two-tier capital-goods and consumption-goods structure. The novelty of the modelling itself is that it explicitly considers agents' balance sheets including deposits, loans, and assets. Furthermore, the banks' choice in credit rationing and loan creation are different. In this case, there is an explicit (due to the balance sheet structure) consideration of the operating cash-flow and the potential that a firm will be able to meet the multi-period loan repayment schedule. The following flowchart, taken from the paper, is a stylized representation.

Their results indicate that the model leads to a quasi-steady state. Under certain parameterizations there emerge over-investment and over-extension of debt, causing a crash followed by a recovery. They also suggest that there is a lot more flexibility in the capital and liquidity realms than in the case where there is a limitation to lend out only what is saved.

That can't be all...?

Indeed it is not, to the best of my knowledge, there have been four follow-on papers since the original model have been proposed. These include extensions into the case of a monetary union with a common market, the extension of the firms in the model to allow for Schumpetarian innovation through investment, and finally, in all cases, analyses of fiscal policy. The whole list:

- Caiani et al. (2018) The effects of fiscal targets in a monetary union: a multi-country agent-based stock flow consistent model - Assuming a common banking sector, the model is extended to a case of 2, 6, and 10 countries.

- Caiani et al. (2019) The Effects of Alternative Wage Regimes in a Monetary Union: A Multi-country Agent Based-Stock Flow Consistent Model

- Caiani et al. (2019) Does Inequality Hamper Innovation and Growth? An AB-SFC Analysis

- Caiani et al. (2020) Are higher wages good for business? An assessment under alternative innovation and investment scenarios

References and Notes

[1] Godley and Cripps, 1983; Godley, 1997; Godley and Wray, 1999; Godley and Zezza, 2006; Godley and Lavoie, 2007; - recent review by Caverzasi and Godin, 2015

[2] Kinsella et al. 2011, Riccetti et al., 2014, and Seppecher, 2012

[3] Deissenberg et al. 2008, Dawid et al. 2012, 2014, etc.

** Cover by Tingey Injury Law Firm on Unsplash