Important links

Abstract

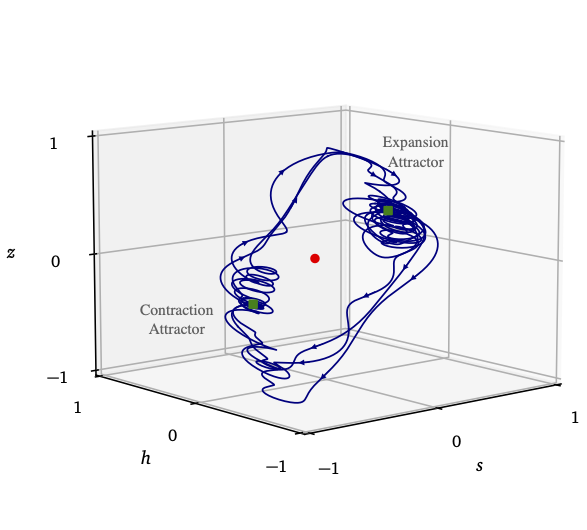

We develop a tractable macroeconomic model that captures dynamic behaviors across multiple timescales, including business cycles. The model is anchored in a dynamic capital demand framework reflecting an interactions-based process whereby firms determine capital needs and make investment de- cisions on a micro level. We derive equations for aggregate demand from this micro setting and embed them in the Solow growth economy. As a result, we obtain a closed-form dynamical system with which we study economic fluctuations and their impact on long-term growth. For realistic parameters, the model has two attracting equilibria: one at which the economy contracts and one at which it expands. This bi-stable configuration gives rise to quasiperiodic fluctuations, characterized by the economy’s pro- longed entrapment in either a contraction or expansion mode punctuated by rapid alternations between them. We identify the underlying endogenous mechanism as a coherence resonance phenomenon. In addition, the model admits a stochastic limit cycle likewise capable of generating quasiperiodic fluctu- ations; however, we show that these fluctuations cannot be realized as they induce unrealistic growth dynamics. We further find that while the fluctuations powered by coherence resonance can cause sub- stantial excursions from the equilibrium growth path, such deviations vanish in the long run as supply and demand converge.

Key figure

Figure 5: A simulated economy’s path for nonzero \(\xi_t\) in the coherence resonance case, smoothed by a Fourier filter to remove harmonics with periods less than 500 business days for a better visualization in the 3D phase space. The regions where the trajectory is dense indicate the contraction and expansion attractors, around which the economy spends most of its time. The relatively straight path segments between the attractors correspond to the economic regime transitions that occur on a relatively rapid timescale.

Data and code

The project is reproducible with Python code available at GitHub.

Citation

@article{NaumannWoleskeEtAl2022CapitalDemandDriven,

title = {Capital {{Demand Driven Business Cycles}}: {{Mechanism}} and {{Effects}}},

shorttitle = {Capital {{Demand Driven Business Cycles}}},

author = {{Naumann-Woleske}, Karl and Benzaquen, Michael and Gusev, Maxim and Kroujiline, Dimitri},

year = {2022},

journal = {Review of Behavioral Economics},

doi = {10.1561/105.00000162},

}