Abstract

The economic shocks that followed the COVID-19 pandemic have brought to light the difficulty, both for academics and policy makers, of describing and predicting the dynamics of inflation. This paper offers an alternative modelling approach. We study the 2020-2023 period within the well-studied Mark-0 Agent-Based Model, in which economic agents act and react according to plausible behavioural rules. We include a mechanism through which trust of economic agents in the Central Bank can de-anchor. We investigate the influence of regulatory policies on inflationary dynamics resulting from three exogenous shocks, calibrated on those that followed the COVID-19 pandemic: a production/consumption shock due to COVID-related lockdowns, a supply-chain shock, and an energy price shock exacerbated by the Russian invasion of Ukraine. By exploring the impact of these shocks under different assumptions about monetary policy efficacy and transmission channels, we review various explanations for the resurgence of inflation in the United States, including demand-pull, cost-push, and profit-driven factors. Our main results are four-fold: (i) without appropriate fiscal policy, the shocked economy can take years to recover, or even tip over into a deep recession; {(ii) the success of monetary policy in curbing inflation is primarily due to expectation anchoring, rather than to the direct economic impact of interest rate hikes; (iii) however, strong inflation anchoring is detrimental to consumption and unemployment, leading to a narrow window of ``optimal’’ policy responses due to the trade-off between inflation and unemployment;} (iv) the two most sensitive model parameters are those describing wage and price indexation. The results of our study have implications for Central Bank decision-making, and offers an easy-to-use tool that may help anticipate the consequences of different monetary and fiscal policies.

Key figure

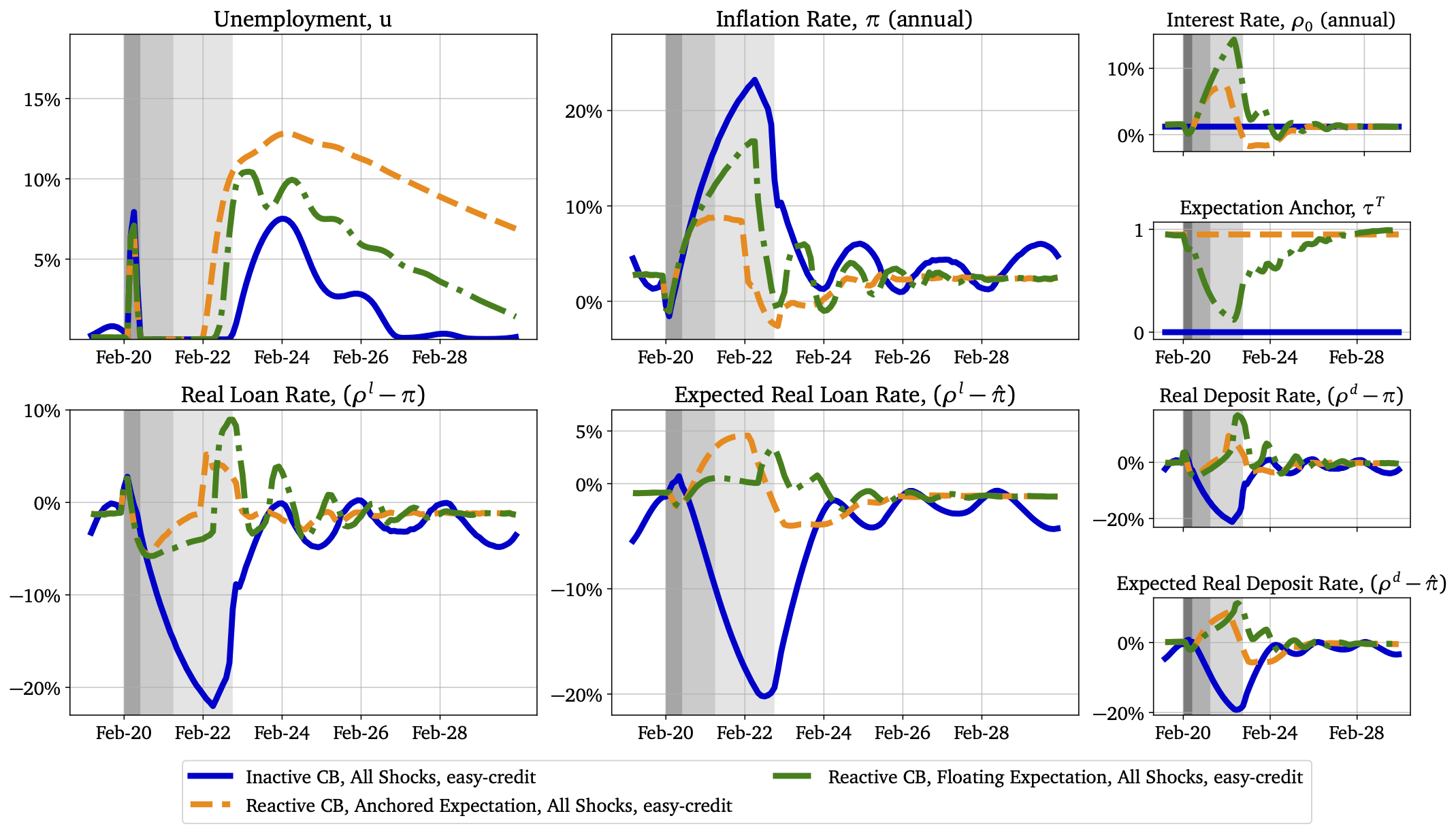

Figure 6: Unemployment and Inflation with all shocks, Easy-Credit policy, and three distinct mon- etary policy scenarios. (Blue lines) Inactive Central Bank scenario. (Orange lines) Reactive Central Bank with Anchored Expectation, with anchor parameter τT = 0.95. A Taylor rule policy successfully decreases peak inflation but increases peak unemployment. (Green lines) Reactive Central Bank with Floating Expectation. Here, trust is eroded during the high inflation period. Monetary policy then fails at reducing inflation, with the risk of hyper-inflation lurking (see section 8); unemployment remains lower because of the higher inflation.

Citation

@unpublished{KnickerEtAl2023PostCOVIDInflationMonetary,

title = {Post-{{COVID Inflation}} \& the {{Monetary Policy Dilemma}}: {{An Agent-Based Scenario Analysis}}},

shorttitle = {Post-{{COVID Inflation}} \& the {{Monetary Policy Dilemma}}},

author = {Knicker, Max Sina and {Naumann-Woleske}, Karl and Bouchaud, Jean-Philippe and Zamponi, Francesco},

year = {2023},

month = jun,

eprint = {2306.01284},

archiveprefix = {arxiv},

}